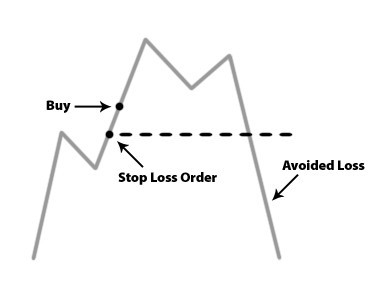

14/08/ · Stop losses can be set in pips or percentages. Stop limit orders will keep your losses to a few percentage points or pips. According to research, a good stop loss percentage for a long-term investor is 15% or 20%, while a good stop loss percentage for a short-term investor is 5%. When using swing trading stop loss orders, always use them. 2 21/09/ · I use trading on M1 or M5, I set the BE at pips and the stop loss is around 5 pips. TP is 15~25 pips Sometimes i try to put the stop loss longer to prevent kicked out without any BE or stop lost,then i lose bigger money 10 Pip Stop Loss Real Test started with help of Investor Access on an account of FXOpen. Description: With leverage up to and maximum spread at the time of the trade 2 pips, then the highest possible loss would be 10 pips + 2 pip spread + a possible * pip spike over the SL = % maximum loss per trade

Restrict Your Losses To Only Pips a Day With This Strategy | Forex Academy

Every trader loves the idea of winning on each trade they take. After all, winning is the sole purpose of trading. Various strategies in the market promise to offer profits every day, but none of them are good enough to make you win every forex stop loss pips trade you take. In the end, almost all of the traders wish for a method that could reap them good profit every day.

But as we all know, trading is less about making forex stop loss pips and more about saving your capital. For this same purpose, we have created the 10 Pip Loss Strategy. The strategy suggests that we must forex stop loss pips two to three trades a day by placing only ten pips stop-loss and go for bigger targets. If we lose two trades and end up winning one, we will be losing only 20 pips, but the gains that are earned on the third trade can be more.

By following this strategy, our primary focus should be on taking three potential trades in a day. As you can see, both the indicators gave us a trading signal at around AM. We activated our trade when the price of the asset is 0. It went a bit up and suddenly dropped down to hit our stop loss. As a result, we ended up losing the trade. The best thing is that we lost only ten pips.

We took this trade on 22 nd April at around AM. When the moving average went below the price, the Stochastic gave a reversal at the oversold area, indicating us to go long in this pair, forex stop loss pips. Right after we went long, the price action blasted to the north and printed a brand new higher high. We end up making 90 pips in this trade, forex stop loss pips. The below price chart represents our third trade on 22 nd April. We took this trade at around PM.

Following our strategy, we made entry, and the price action has printed a brand new higher high. This trade gave us a profit of 80 pips. By following this strategy, we can make profits on every single trading day. Note: Use this strategy only when you see the potential of having at least three trades in a single day. Otherwise, there is no point in using this strategy.

This is the first trade we activated on 13 th April at around AM. Overall, the market was in a strong downtrend, and when it pulled back, both the indicators gave us a sell signal. After we went short, the price sharply goes down and prints a brand new lower low, forex stop loss pips. Overall, this pair was also in forex stop loss pips strong downtrend, and we activated the trade when both the indicators gave us a sell signal. When price action pulled back to the moving average, forex stop loss pips, the Stochastic also gave us a reversal at the overbought area, indicating us to go short.

In total, we took three trades, and all of them hit our take-profit. If you observe, even if we would have lost two trades and won only one, we would still have ended up on the winning side.

In a strong trending market, it is easy to win all the trades we take. All you need to do is to follow the rules of the strategy very well.

To sum it up, forex stop loss pips, with minimum risk, forex stop loss pips, we gained a profit of pips from the market. We hope you understood the strategy well. Please try and trade this strategy in a demo account before applying it to forex stop loss pips live market. Save my name, email, and website in this browser for the next time I comment. About Us Advertise With Us Contact Us. Forex Academy. Home Forex Trading Strategies Forex Basic Strategies Restrict Your Losses To Only Pips a Day With This Strategy.

RELATED ARTICLES MORE FROM AUTHOR. Trading Reversals Using Bullish Reversal Candlestick Patterns. Forex stop loss pips Bollinger Bands to Time the Rectangle Pattern. Four Powerful Above the Market Trading Strategies that Work. LEAVE A REPLY Cancel reply.

Please enter your comment! Please enter your name here. You have entered an incorrect email address! Popular Articles. How Important are Chart Patterns in Forex? Forex Chart Patterns Might Be an Illusion 4 September, Chart Patterns: The Head And Shoulders Pattern 16 January, Academy is a free news and research website, offering educational information to those who are interested in Forex trading.

EVEN MORE NEWS. Understanding the Economics of Cryptocurrencies 13 June, Trading Reversals Using Bullish Reversal Candlestick Patterns 12 June, Using Bollinger Bands to Time the Rectangle Pattern 11 June, POPULAR CATEGORY Forex Market Analysis Forex Brokers Forex Service Review Crypto Market Analysis Forex Signals Forex Cryptocurrencies Academy - ALL RIGHTS RESERVED.

Where Your Stop Loss Should Day Trading Forex

, time: 12:09Using Stop Loss Orders in Forex Trading

19/06/ · Place the stop-loss just ten pips above the entry. Take profit placement depends on the market state. If the seller movement is strong, expect a brand new lower low; if the momentum is a slow, exit at the most recent lower low. The image below represents a sell signal in the CHF/JPY Forex blogger.comted Reading Time: 5 mins 07/05/ · Stop loss order is a strategy to protect your funds from more losses in a losing trade by automatically exiting you. The market price triggers a stop loss order while stop limit order is pegged on a particular price limit. You can set stop loss in pips or percentage. Setting stop limit orders will limit your losses to a small percentage or pips 21/09/ · I use trading on M1 or M5, I set the BE at pips and the stop loss is around 5 pips. TP is 15~25 pips Sometimes i try to put the stop loss longer to prevent kicked out without any BE or stop lost,then i lose bigger money

No comments:

Post a Comment