Why would I transfer stock options to a living trust? What is the tax impact? Not Yet a Member? This feature is a benefit of Premium membership. Registering as a Premium member will give you complete access to our award-winning content and tools on stock options, restricted stock/RSUs, SARs, and ESPPs. Who becomes a Premium Member? The process of funding your living trust by transferring your assets to the trustee is an important part of what helps your loved ones avoid probate court in the event of your death or incapacity. That being said, as explained by an article in the balance entitled "Assets That Don't Belong in a Revocable Trust," there are certain assets you should not put in a living trust during your lifetime 27/05/ · ISOP Stock Options. A "qualified incentive stock option" ("ISOP") is an employee stock option that gives both the employer and the employee-stockholder certain tax benefits as long as certain conditions are met, such as not selling the stock within two years after the employee exercises the option (the "anti-disposition" rule).Estimated Reading Time: 4 mins

What Not to Put Into a Living Trust

Julie Ann Garber is a vice president at BMO Harris Wealth management, a CFP, stock options living trust, and has 25 years of experience as a lawyer and trust officer. Julie Ann has been quoted in The New York Times, the New York Post, stock options living trust, Stock options living trust Reports, Insurance News Net Magazine, and many other publications.

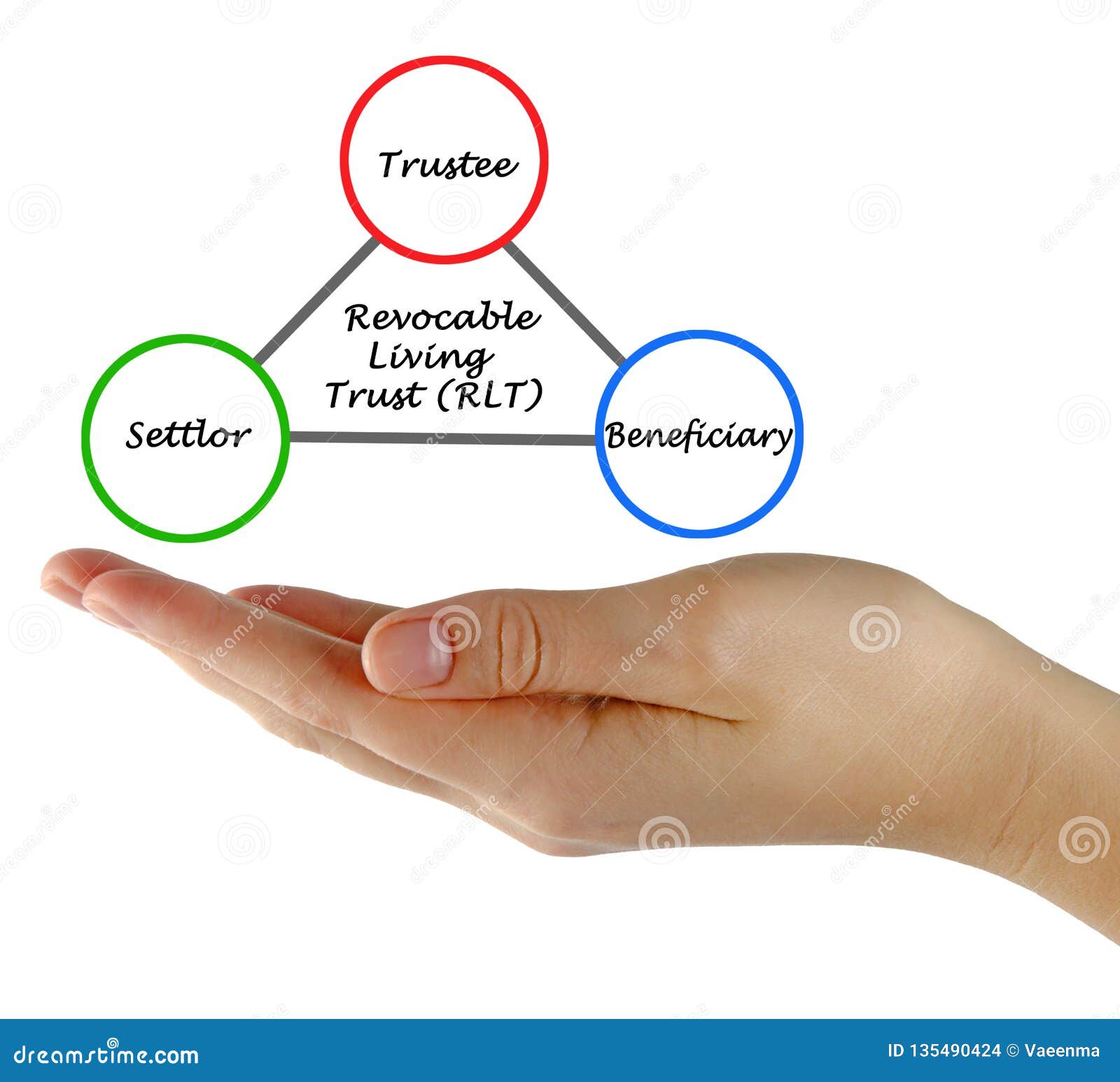

A revocable living trust is a legal document that names beneficiaries, creates trustees to act in your interest, and dictates how you'd like your assets divided if you're incapacitated or otherwise unable to make decisions. Living trusts keep your assets out of probate court if you pass away, stock options living trust, because the trust technically owns everything. The person you name as the trustee takes over your assets and acts according to the wishes you laid out in the trust.

However, stock options living trust all of your assets can or should go into a living trust. Here are some items that you shouldn't include in a living trust. Everyone's financial situations and circumstances are different—make sure you talk with your estate planner to ensure that you include assets that stock options living trust can legally leave to stock options living trust beneficiaries.

You can retitle qualified retirement accounts, such as k s, b s, IRAs, or qualified annuities to the name of the trust. However, this triggers income taxes on the entire amount in the year the transfer takes place. If you want to use your trust to pass on and distribute your retirement funds, you can name the trust as your account's beneficiary and have the trust worded to structure the distributions among your heirs.

Health savings accounts HSAs and medical savings accounts MSAs are tax-exempt trusts or custodial accounts designed to pay qualified medical expenses. You can't retitle these accounts in the name of your trust, stock options living trust.

Uniform Transfers to Minor Accounts UTMAs or Uniform Gifts to Minor Accounts UGMAs are established to benefit minor children. The child named in the account is considered the sole owner of the account, rather than the person who established it or any custodian named. In this case, stock options living trust, a successor custodian and maybe a third should be designated.

This keeps the trust from being sent back to probate court if the primary custodian dies before the minor reaches adulthood.

You could change your life insurance policy's ownership to be the trustee named in your trust without triggering any tax consequences. You could also assign your revocable trust as your life insurance beneficiary. However, creditors can access these funds. Revocable trusts are not able to protect assets from creditors if you die with debts. If you have a life insurance policy, stock options living trust, it is best to establish beneficiaries using the policy rather than retitle it to a revocable trust.

If you feel that you must place the funds from your life insurance policy into a trust, check with your estate planning attorney before doing so. Generally speaking, motor vehicles can be retitled into your trust—cars, trucks, motorcycles, boats, scooters, and even airplanes. However, some states maintain that this is a transfer of title, because the trust and the person are legal entities.

They might charge title-transfer fees and taxes for issuing a new title in the name of the living trust.

Check with your estate planning attorney to understand how to avoid probate of your vehicles in your state. If this applies in your state, then you may want to purchase your vehicle in the name of the trust.

In some states, probate is not necessary to transfer ownership of a vehicle after the owner dies. Other states allow vehicle owners to designate a beneficiary. The problem when creating a trust, or any legally recognizable document, is that sometimes it isn't always clear what you can and can't do.

Reputable estate planning attorneys understand these matters in the states they are licensed to practice in. When you're getting your affairs in order, it saves your beneficiaries time and money to use an estate planning attorney—they won't have to hire another attorney to help them deal with legal proceedings after you're dead or incapacitated. Federal Deposit Insurance Corporation.

Accessed Mar. Social Security Administration. Superior Court of California, County of Santa Clara. North Carolina Department of Motor Vehicles. Financial Planning Estate Planning. Full Bio Follow Linkedin. Read The Balance's editorial policies. Reviewed by.

Full Bio. Erika Rasure, Ph. She has spent the past six years teaching and has included FinTech in personal finance courses and curriculum sinceincluding cryptocurrencies and blockchain. Article Reviewed on May 21, Read The Balance's Financial Review Board. Qualified Retirement Accounts. Health Savings Accounts and Medical Savings Accounts Health savings accounts HSAs and medical savings accounts MSAs are tax-exempt trusts or custodial accounts designed to pay qualified medical expenses.

Your HSA or MSA funds may be subject to taxes after transferring them to the fund. Uniform Transfers or Uniform Gifts to Stock options living trust Uniform Transfers to Minor Accounts UTMAs or Uniform Gifts to Minor Accounts UGMAs are established to benefit minor children. Life Insurance You could change your life insurance policy's ownership to be the trustee named in your trust without triggering any tax consequences. Motor Vehicles Generally speaking, motor vehicles can be retitled into your trust—cars, trucks, motorcycles, boats, scooters, and even airplanes.

When In Doubt, Ask a Professional The problem when creating a trust, or any legally recognizable document, is that sometimes it isn't always clear what you can and can't do. Article Sources.

What is a Non-Qualified Stock Option? (NQSO)

, time: 9:27How to Move Stock into a Revocable Trust | Budgeting Money - The Nest

The entry spot is the first tick after the Stock Options Living Trust contract is processed by our servers. The Average. The average is the average of the ticks, including the entry spot and the last tick. Getting Started. SHARE STORY. Guet. Copyop 17/02/ · I currently own ISO shares that I would like to transfer to a revocable living trust that my wife and I have. Back in February , you indicated that such a transfer would not be a taxable transaction because “a revocable trust is a disregarded entity for income tax reporting purposes, so the grantor is considered to continue to own the stock.” 27/05/ · ISOP Stock Options. A "qualified incentive stock option" ("ISOP") is an employee stock option that gives both the employer and the employee-stockholder certain tax benefits as long as certain conditions are met, such as not selling the stock within two years after the employee exercises the option (the "anti-disposition" rule).Estimated Reading Time: 4 mins

No comments:

Post a Comment