13/04/ · Rsi 3 Trading Strategy. Relative Strength Index is the most renowned and reliable momentum indicator. The RSI Trading Strategy is used as an RSI stock strategy, RSI forex strategy, and an RSI options strategy. Go short on the next bar’s open. It didn’t make logical sense to me, but all that matters is the data RSI (3) trading strategy The are 3 main ways I know off that you can use to trade with the Relative Strength Indicator and they are: trade when the RSI is in the oversold regions, which means you buy. trade when the RSI in the overbought region, which means you look to sell. trade when you see RSI divergence, this simply means that price and RSI are going in completely 09/12/ · The final common RSI trading strategy is the 50 level crossover. Unlike the previous 2 strategies, we use the 50 level on the RSI as a confirmation of a trend. So when we think that a trend is in place, we take a short trade when price closes below the 50 and a long trade when it closes above

RSI Trading Strategy Results: 3 RSI Strategies Backtested » Trading Heroes

Relative Strength Index what rsi 13-3 trading strategy it? In this post you will learn a lot about this popular forex indicator including:. The Person that developed the RSI Indicator was an American, J, rsi 13-3 trading strategy. Welles Wilder, Jr. He also developed other popular forex indicators like Average Directional Index, Average True Range and Parabolic SAR. Here was a mechanical engineer, later turned real estate developer who later became a technical analyst.

In order to rsi 13-3 trading strategy the relative strength index, you first need to calculate the RS, which is the Relative Strength.

This RSI calculation is based on 14 periods, rsi 13-3 trading strategy, which is the default setting that is set in the MT4 trading platform. The second, and subsequent, calculations are based on the prior averages and the current gain loss:. Note here that taking the when you take the previous average gain or previous average loss plus the current value of gain or loss what you are doing is applying a smoothing technique which is very similar to the the smoothing technique that is used in the calculation of exponential moving average.

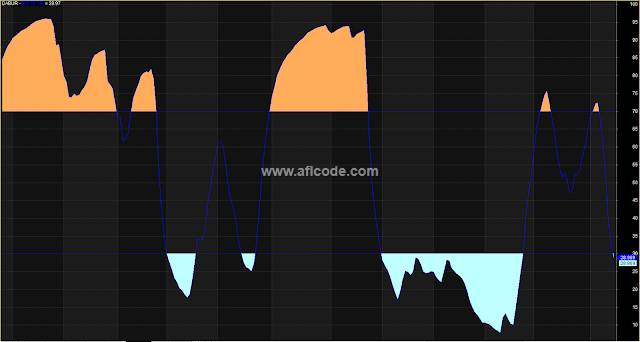

So what does smoothing effect have on the Relative Strength Index? Well it means, the RSI value becomes more accurate as the calculation period extends. So when you use the relative index formula to calculate all the RSI values and plot them on a chart, this is what you get: a relative strength index chart like below. This is based on the MT4 Trading Platform:.

Remember, the Relative Strength Index Indicator Is a oscillator so it fluctuates between one level so what does this actually tell you? As you can see, the RSI indicator can potentially show you the oversold and overbought conditions in the forex market. The are 3 main ways I know off that you can use to trade with the Relative Strength Indicator and they are:.

In order to trade RSI divergence, you must be able to spot the sell trading setup and buy trading setup when it is forming. Let me give you an example of a sell setup…for a sell setup, remember, the market must be in an uptrend first:. Every forex indicator has its pros and cons just like any forex strategies. Similarly if RSI has gone past 70 level does not mean that price is going to start heading down. The chart below shows the market in a strong uptrend and how the RSI indicator behaves in rsi 13-3 trading strategy a situation by giving many false sell signals:.

In this post you will learn a lot about this popular forex indicator including: 3 main way to trade the RSI indicator 5 things you need to know about the RSI indicator who is the genius that developed the Relative Strength index indicator?

definition of relative strength index what is the formula to calculate the relative strength index? what a relative index chart looks like on mt4 trading platform disadvantages of the RSI indicator and lots more so to find out, keep reading… [toc] WHAT IS THE RELATIVE STRENGTH INDEX-RSI? WHO DEVELOPED THE RSI INDICATOR? But then, to calculate Relative Strength: you need to know how to calculate the Average Gain and also calculate the Average Loss, rsi 13-3 trading strategy.

Note also here that the Losses are expressed as positive values, not negative values. The very first calculations for average gain and average loss are simple 14 period averages. RELATED Buy Sell Arrow Indicator Mt4. RELATED Center Of Gravity Indicator Mt4 DOWNLOAD LINK, rsi 13-3 trading strategy.

Prev Article Next Article.

Bollinger Bands and RSI Trading Strategy (Simple and Effective)

, time: 9:52Relative Strength Index Indicator RSI (3 AWESOME WAYS TO TRADE IT)

02/04/ · Strategy #3 –RSI 2 and Moving Average Trading Strategy. Tweaking the settings of an indicator can often result in interesting combinations. One such combination is the RSI 2 period along with 34 EMA and 5 EMA. Here, we go long when the price is above 34 EMA and has pulled back to it, is below 5 EMA and the RSI (2) has crossed above 50 from below The are 3 main ways I know off that you can use to trade with the Relative Strength Indicator and they are: trade when the RSI is in the oversold regions, which means you buy. trade when the RSI in the overbought region, which means you look to sell. trade when you see RSI divergence, this simply means that price and RSI are going in completely 06/01/ · The final RSI strategy is a little different. This strategy uses the RSI 50 level, instead of the 70/30, like most strategies use. You can get the complete RSI50 trading plan here. I’ve never done any testing with this flavor of RSI trading, so I didn’t know what to expect. It didn’t make logical sense to me, but all that matters is the data

No comments:

Post a Comment